Stablecoins Disrupt SWIFT in Cross-Border Payments and Remittances

Stablecoins are revolutionizing financial systems, evolving beyond a crypto niche to become crucial in global commerce. The dominant players, USDT and USDC, are leading the charge with significant market capitalizations.

- Key Use Cases:

- Hedging in high-inflation economies

- Cross-border payments and remittances

- DeFi and programmable finance

- Trading and liquidity

Among these, cross-border payments have substantial growth potential, with USD stablecoins increasingly replacing traditional systems like SWIFT for smaller transfers.

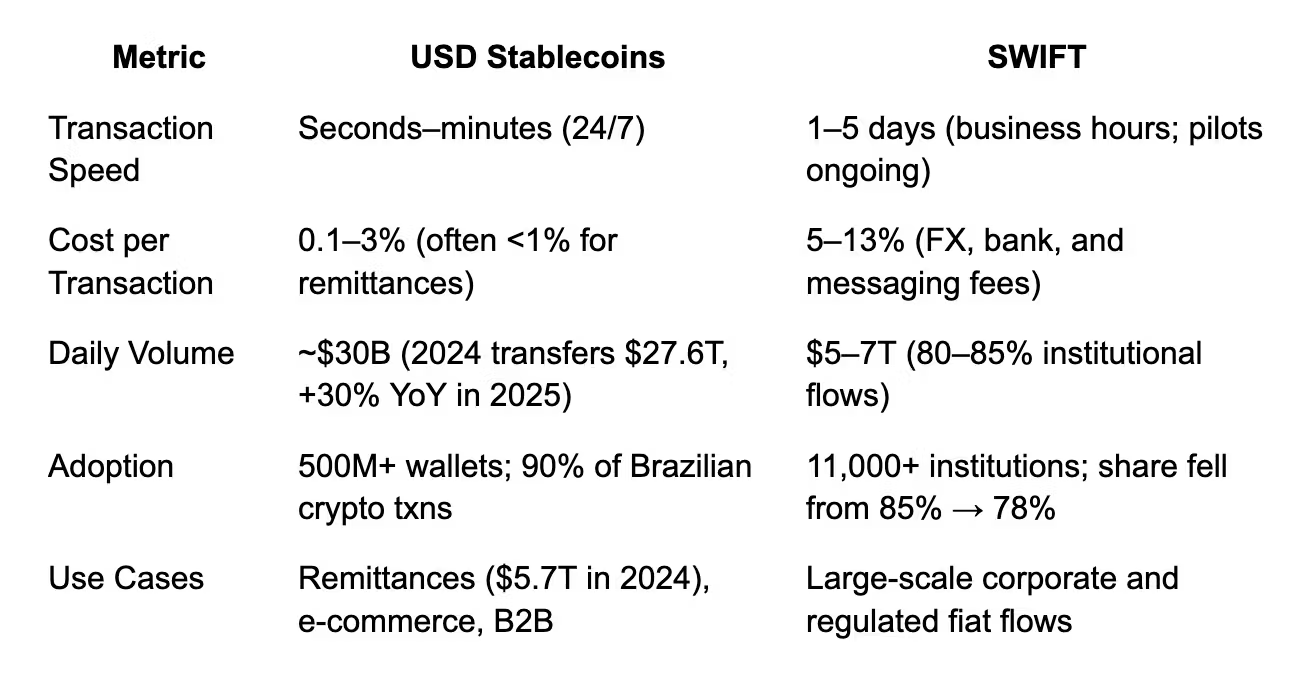

Stablecoins vs. SWIFT

While stablecoins currently represent less than 1% of global money flows, they offer faster and cheaper transactions, particularly in remittances, B2B payments, and e-commerce.

The Problem: Two States of Money

Stablecoins facilitate instant digital transactions, yet local fiat currencies remain essential, creating friction. Liquidity providers face operational challenges due to this dual state, impacting stablecoin adoption.

The Solution: FX on-chain

FX-on-chain protocols unify digital and fiat currencies into a single digital state, allowing direct swaps between USD stablecoins and local currency stablecoins. This results in:

- Instant conversion: Seamless exchange between stablecoins and fiat.

- Flow matching: Real-time liquidity recycling akin to global FX markets.

Looking Ahead

Stablecoins are becoming integral to global commerce, providing solutions from inflation hedges to invoice settlements. Future development hinges on:

- Expanding FX on-chain solutions for multi-currency settlements.

- Establishing regulatory frameworks that balance innovation and safety.

- The emergence of non-USD stablecoins to enhance local adoption.

The transition is from "digital gold" with Bitcoin to "digital fiat" through stablecoins, paving the way for universal digital currency adoption.