Tether Reports $2.5 Billion Net Profit in Q3 2024

On Thursday, Tether (USDT), the largest stablecoin issuer, published its third-quarter (Q3) assurance opinion report, showcasing significant financial results amid a broader market recovery led by Bitcoin (BTC).

Total Tether Assets Reach All-Time High

The report, conducted by accounting firm BDO, indicates a net profit of $2.5 billion for Q3, contributing to a total profit of $7.7 billion for the first nine months of 2024. Total assets reached an all-time high of $134.4 billion.

Tether's stablecoin supply now exceeds $120 billion in circulation, a 30% increase since the start of the year, reflecting growing global demand for USDT. Reserves are over $105 billion in cash and equivalents, including $102.5 billion in US Treasury bills (T-Bills). If treated as a country, Tether would rank among the top 18 holders of US Treasuries globally, surpassing Germany and Australia.

CEO Ardoino Criticizes ‘Inclusion Washing’ By Other Firms

CEO Paolo Ardoino emphasized Tether’s commitment to transparency and risk management, noting an increased reserve buffer exceeding $6 billion and investments across sectors such as renewable energy, Bitcoin mining, artificial intelligence, telecommunications, and education.

In a recent social media post, Ardoino highlighted USDT's role in promoting financial inclusion in developing countries, stating it serves as a "digital dollar" for many lacking traditional banking services. He acknowledged that around 3 billion people still lack access to basic financial services.

Ardoino criticized “financial inclusion washing,” where companies claim to enhance financial access without concrete outcomes. He stated Tether aims to foster “a more inclusive financial ecosystem.”

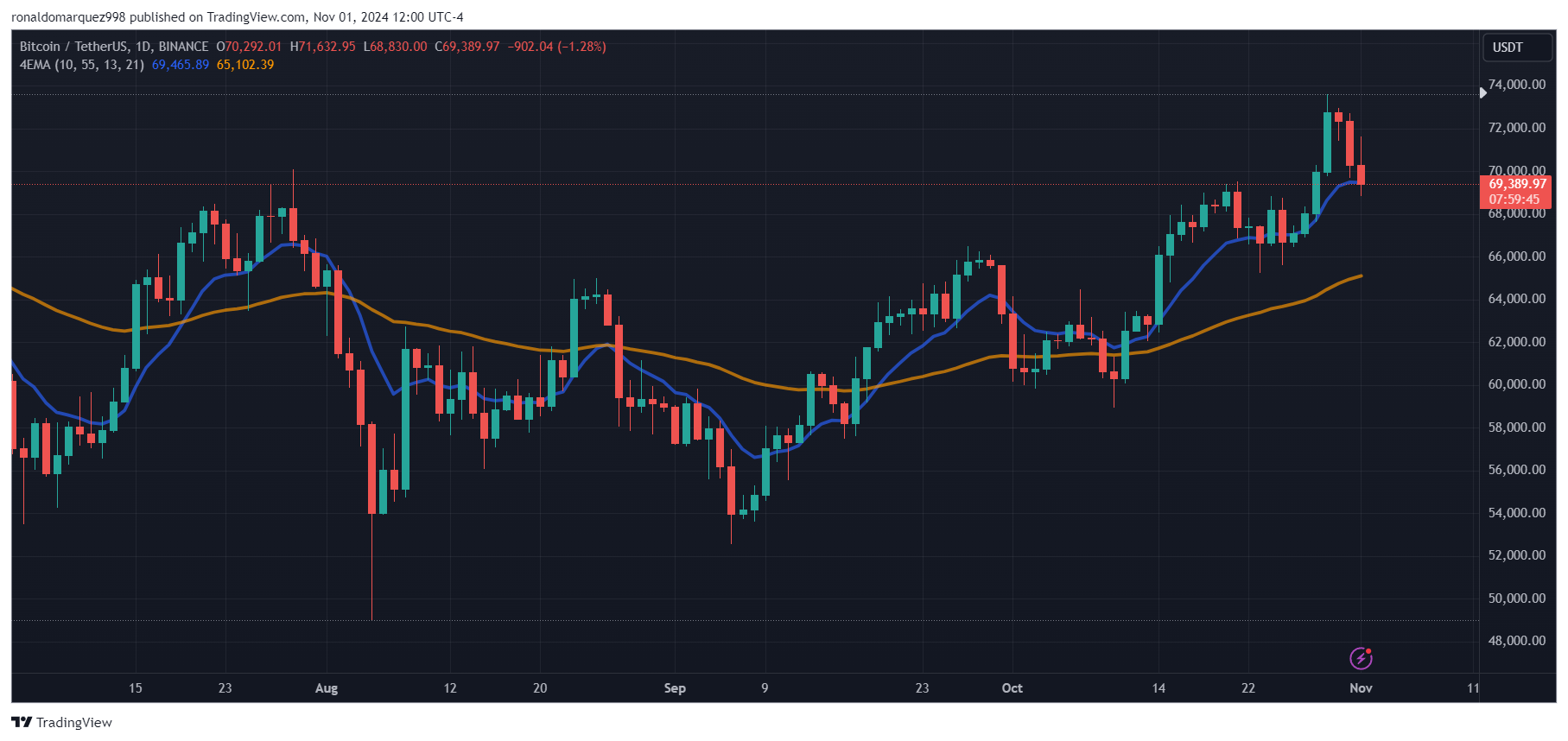

At the time of writing, Bitcoin was trading at $69,390, having dropped 1.2% in the past 24 hours after failing to maintain consolidation above the $70,000 resistance level.

Featured image from DALL-E, chart from TradingView.com