9 0

Tether Shifts Reserves to Bitcoin, Gold Amid Reduced Treasury Holdings

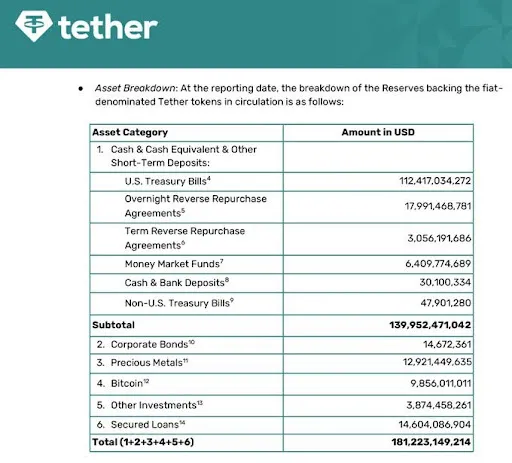

Tether has adjusted its reserve strategy, reducing reliance on US Treasuries while increasing investments in Bitcoin and gold. This indicates a shift towards assets less tied to traditional financial systems.

Key Points:

- Tether reduced its US Treasury holdings, anticipating future Federal Reserve rate cuts.

- Increased allocations to Bitcoin and gold signal readiness for macroeconomic changes.

- S&P Global warns of potential exposure due to increased volatility in asset values.

- Tether CEO states the company holds no toxic assets and reflects a move towards new financial systems.

Market Reactions:

- Concerns arise about Tether's solvency if risk assets drop significantly.

- Tether operates on a fractional-reserve model similar to traditional banks, maintaining liquidity unless faced with panic redemptions.

- USDT is supported by a diverse asset portfolio totaling $174 billion.