5 0

USDC Inflows Surge as Traders Eye Bitcoin Dip

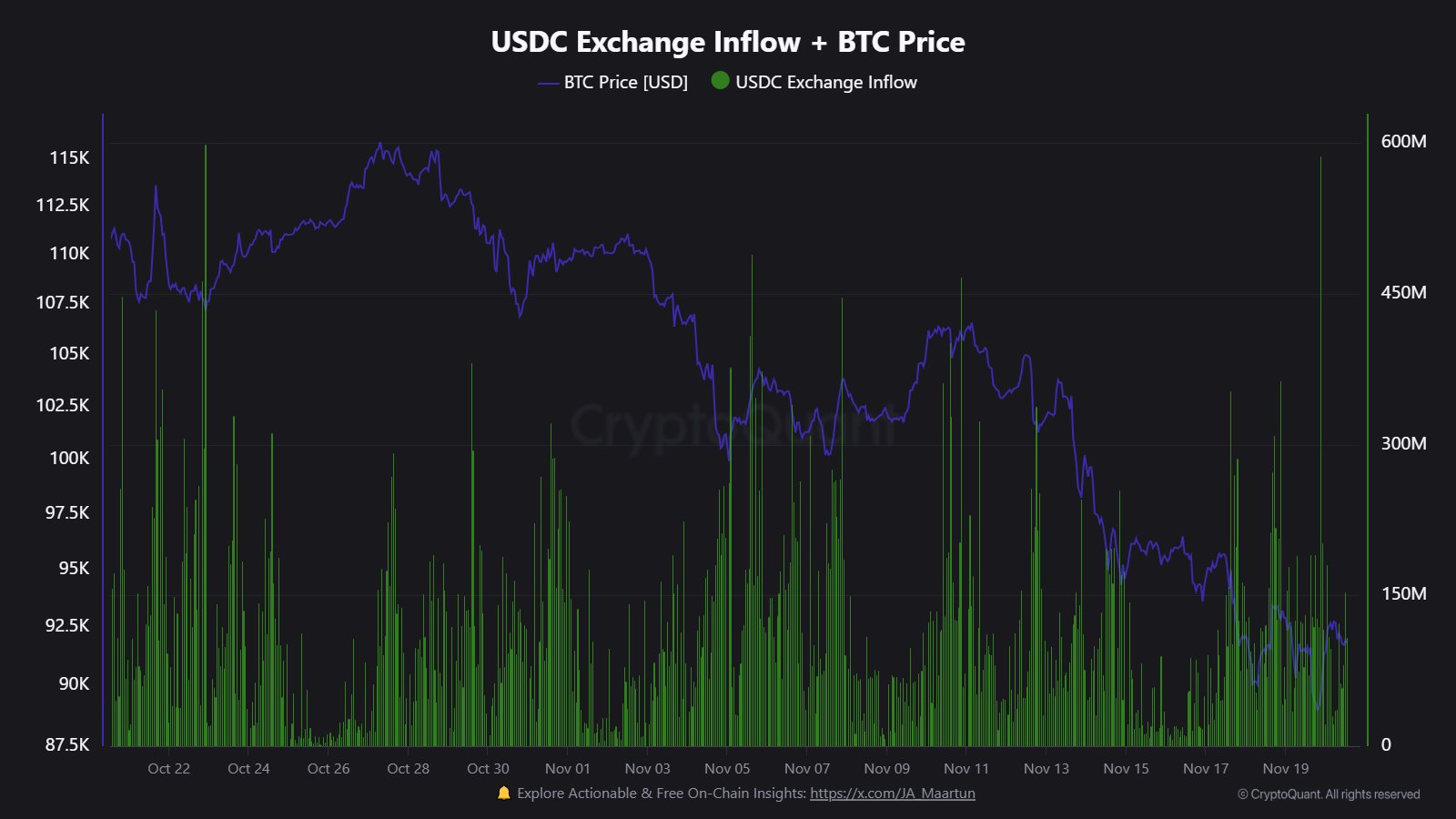

Recent on-chain data indicates a significant influx of USDC into exchanges, suggesting that investors may be preparing to purchase the dip in Bitcoin.

Key Points

- The USDC Exchange Inflow has experienced multiple spikes, which may imply an upcoming shift in Bitcoin trading activity.

- While stablecoin transactions do not affect their prices, high inflows often signal investors are ready to buy other volatile assets like Bitcoin.

- This pattern is typically considered a bullish indicator as traders convert stablecoins into cryptocurrencies during favorable market conditions.

- The latest surge coincides with a recent downturn in digital asset prices, hinting at potential buying opportunities.

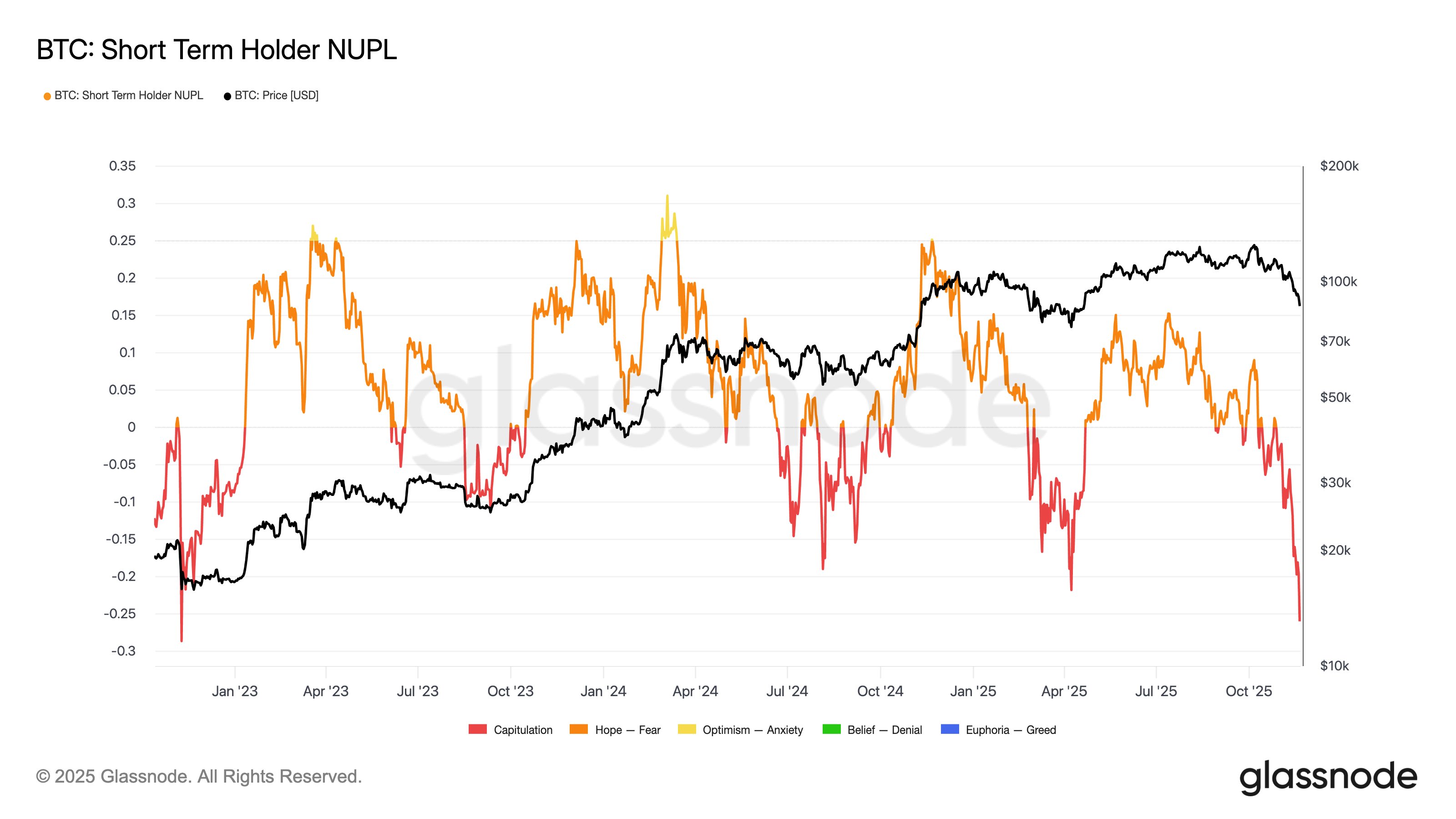

Meanwhile, short-term Bitcoin holders (STHs) have faced increased unrealized losses due to the recent market slump. STHs, who acquired coins within the past 155 days, have seen their positions dip below their acquisition values, reaching a loss level unmatched since November 2022.

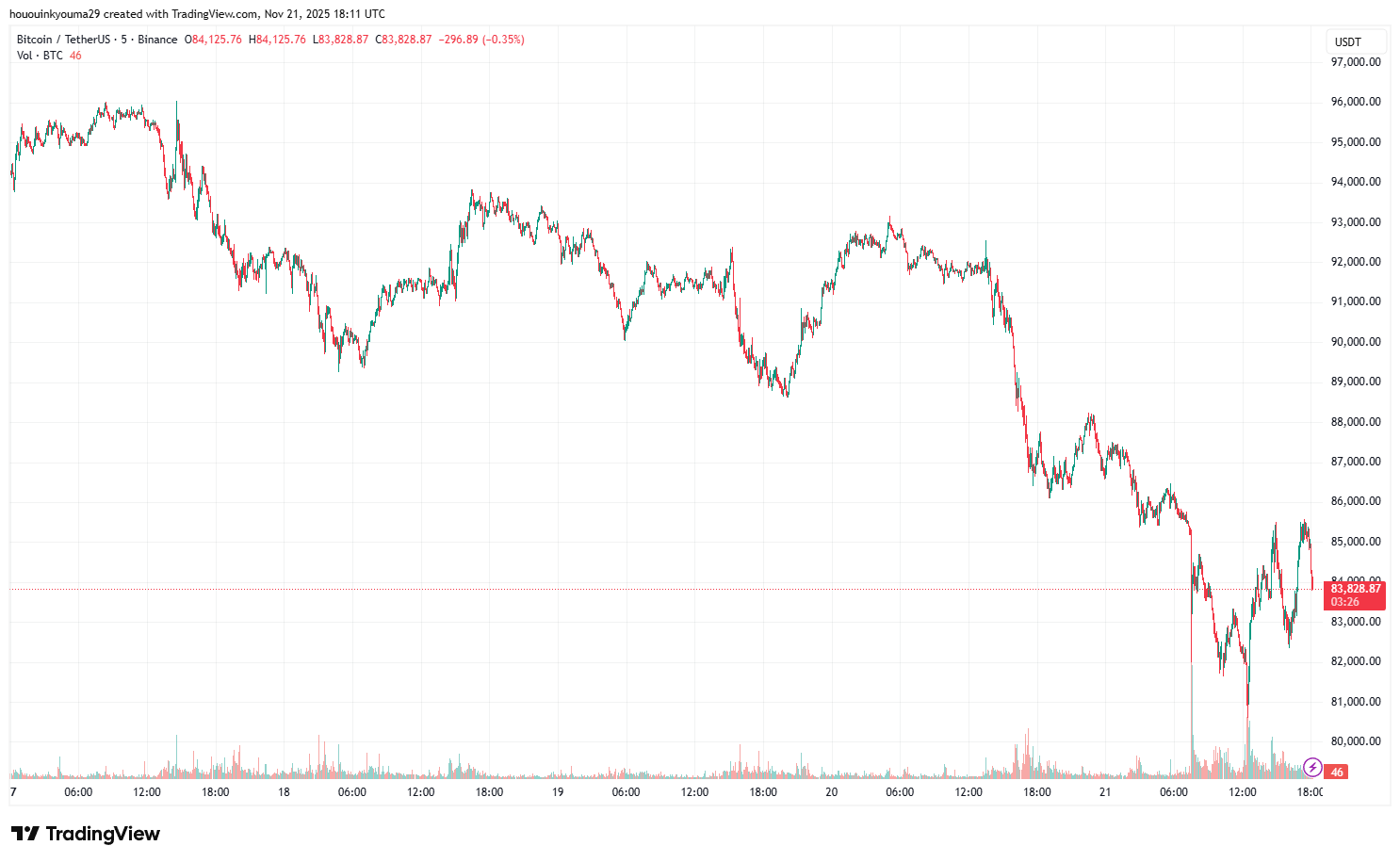

BTC Price Update

Bitcoin briefly dropped below $81,000 but has rebounded slightly to $83,900.