8 0

USDT Circulating Supply Slows, Potential Impact on Crypto Market

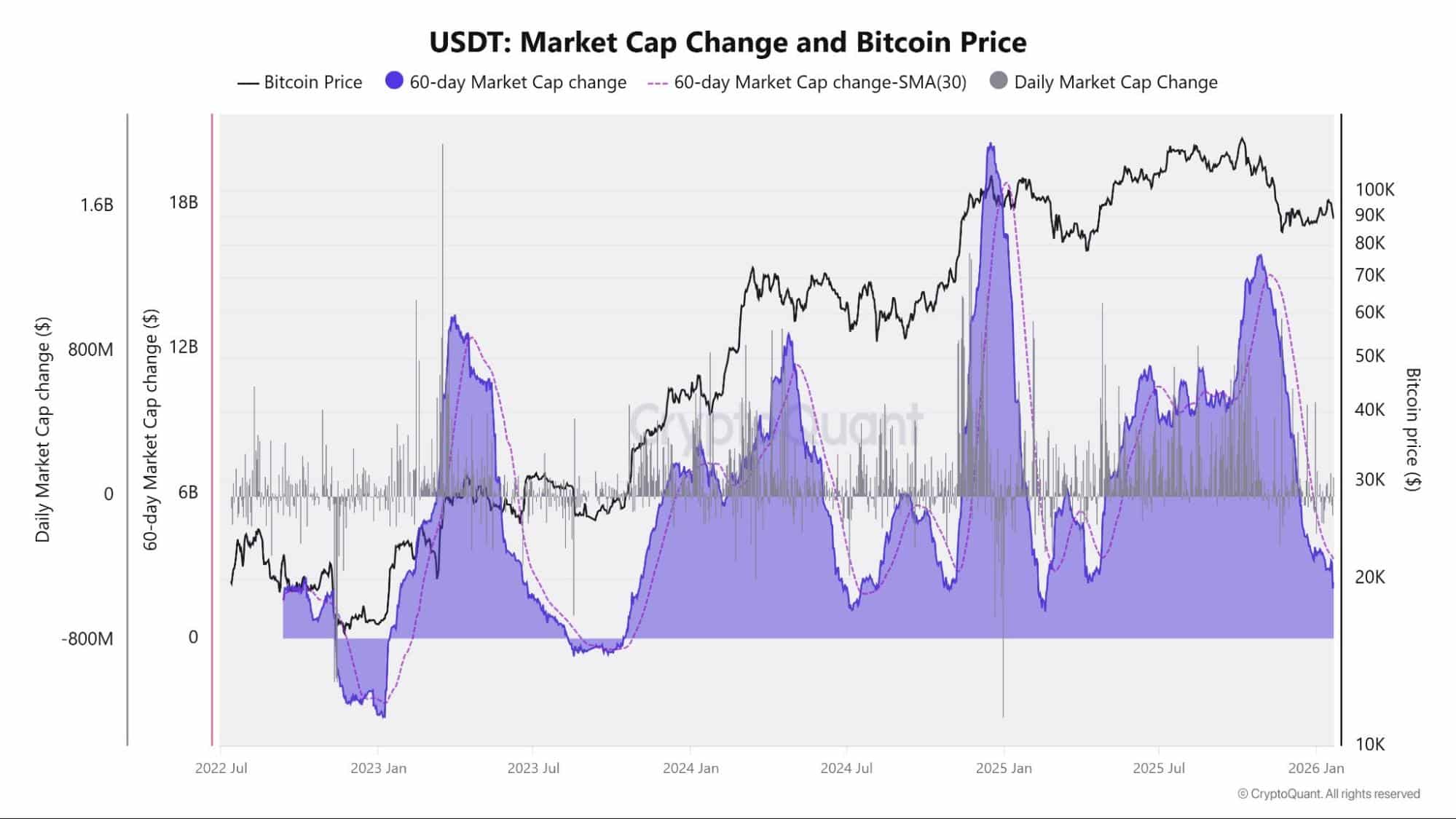

The demand for Tether's USDT stablecoin has significantly slowed down in January 2026, raising concerns for the crypto market. A slowdown in USDT growth could impact Bitcoin's price rally.

Key Points:

- Tether's circulating supply is experiencing a sharp slowdown, indicating reduced stablecoin liquidity.

- The 60-day average of USDT market cap changes shows a decline from $15 billion to $3.3 billion since late November 2025.

- This slowdown may affect overall crypto market momentum, as rapid USDT growth often coincides with Bitcoin rallies.

- USDT market cap on Ethereum has declined, with USDT trading below $1, indicating capital outflows.

- Tether Treasury recently burned 3 billion USDT, marking the largest burn in three years.

- Outflows could lead to a shift in the stablecoin market, potentially causing a broader downturn in crypto.

- Iran's central bank purchased $507 million in USDT to bypass US sanctions and stabilize the rial.

The recent developments suggest caution among large holders due to rising macro uncertainties and geopolitical risks. If outflows increase, the stablecoin market's capitalization might enter a corrective phase, impacting the broader crypto market.