6 0

Visa Partners With Aquanow to Expand Stablecoin Settlements in CEMEA Region

Visa's Stablecoin Expansion with Aquanow

On November 27, Visa Inc. announced a partnership with crypto fintech company Aquanow to enhance stablecoin settlement options in Central and Eastern Europe, the Middle East, and Africa (CEMEA).

- The collaboration connects Visa's payment network with Aquanow's digital asset infrastructure.

- This enables financial institutions to use stablecoins like USDC for transactions.

- The setup aims to reduce costs and accelerate cross-border financial processes.

Impact on Financial Settlements

- The initiative responds to demand for continuous settlements without traditional banking delays.

- Visa's previous USDC pilot shows a $2.5 billion annualized monthly run rate.

- Godfrey Sullivan from Visa describes it as an upgrade to regional payment systems.

- Aquanow CEO Phil Sham highlights internet-speed transparency in institutional flows.

Stablecoin Market Growth

- In 2025, Visa expanded its stablecoin efforts through various pilots and support for multiple stablecoins.

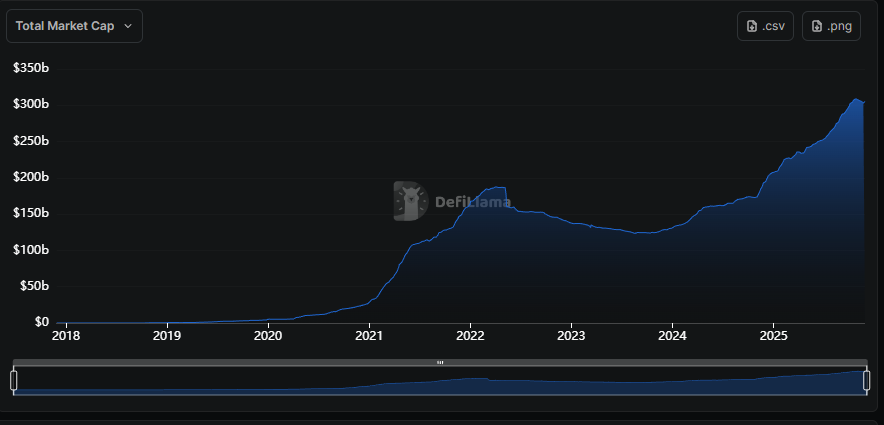

- The stablecoin market cap exceeded $300 billion, nearing $305 billion.

- USDT and USDC dominate with 60% and 25% market shares respectively.

- Growth is driven by regulatory approvals and demand for quick transfers in emerging markets.

Visa's move aligns with its strategy to integrate blockchain technologies, reflecting a trend that started in 2020 and continues today. Stablecoins now compete with significant portions of Visa’s transaction volume, reaching $6 trillion in Q1 2025.