0 0

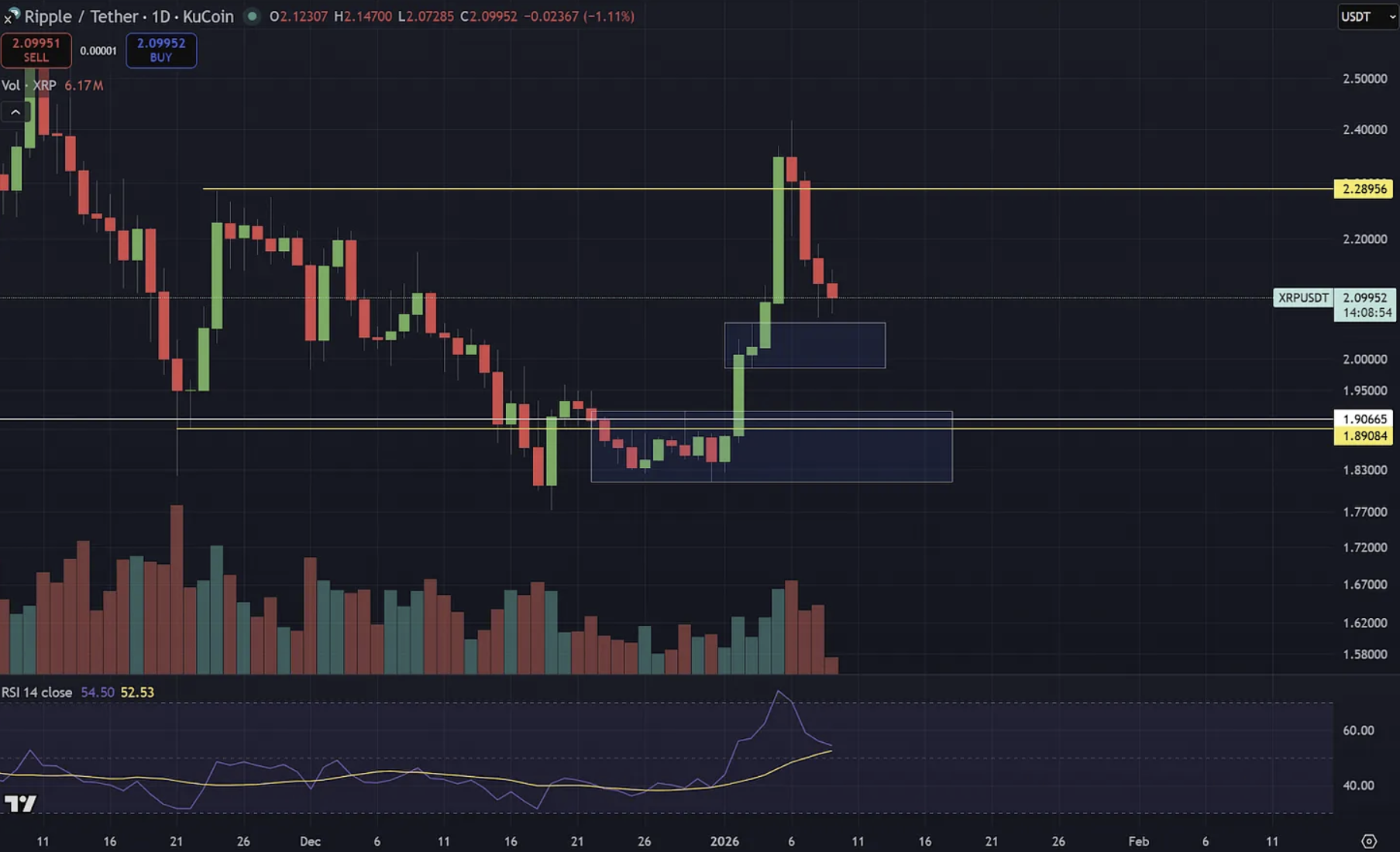

Analyst Sees Final XRP Buying Chance with Potential Retest at $1.90-$1.82

Will Taylor from CryptoinsightUK suggests that XRP may be poised for a favorable long entry if the market sees another volatility-driven pullback. This relies on whether Bitcoin forms a double-bottom and drags major altcoins into deeper liquidity before an upward move.

- Early 2026 presents two potential paths: a familiar pullback-and-recover structure or a continuation higher without retracement.

- Taylor closed short-term trades due to low-timeframe conditions and event risks, such as US tariff rulings.

- For Ethereum, Taylor sees a preference for the double-bottom scenario, citing liquidity below $2,600 as a magnet for price action.

- Regarding XRP, Taylor's critical decision zones are between holding at current support or moving to a deeper zone around $1.90-$1.82 for better risk-to-reward ratios.

- The daily RSI on XRP is nearing a bearish cross, indicating a potential washout before further trend continuation.

- Taylor remains bullish long-term, seeing potential for an epic rally spurred by economic stimuli and a final market shakeout.

- His medium-term XRP price target is $3.40 to $4.40, with a long-term view supporting the $8-$12 range.

Analyst @thecryptomann1 emphasizes Bitcoin's confirmation through reclaiming $105,000, aligning with bull market support bands. He notes USDT dominance showing weakness, which could lead to a risk-on breakout in major cryptocurrencies.

At press time, XRP is trading at $2.05.