$14B Stablecoins Minted Post-October Crash Signals Crypto Liquidity Return

The crypto market is experiencing significant selling pressure, with Bitcoin trading below $100,000 for the first time since May. Altcoins are also declining, continuing a downtrend that began in early October. Despite this bearish sentiment, capital inflows are increasing, indicating potential accumulation preparation by investors.

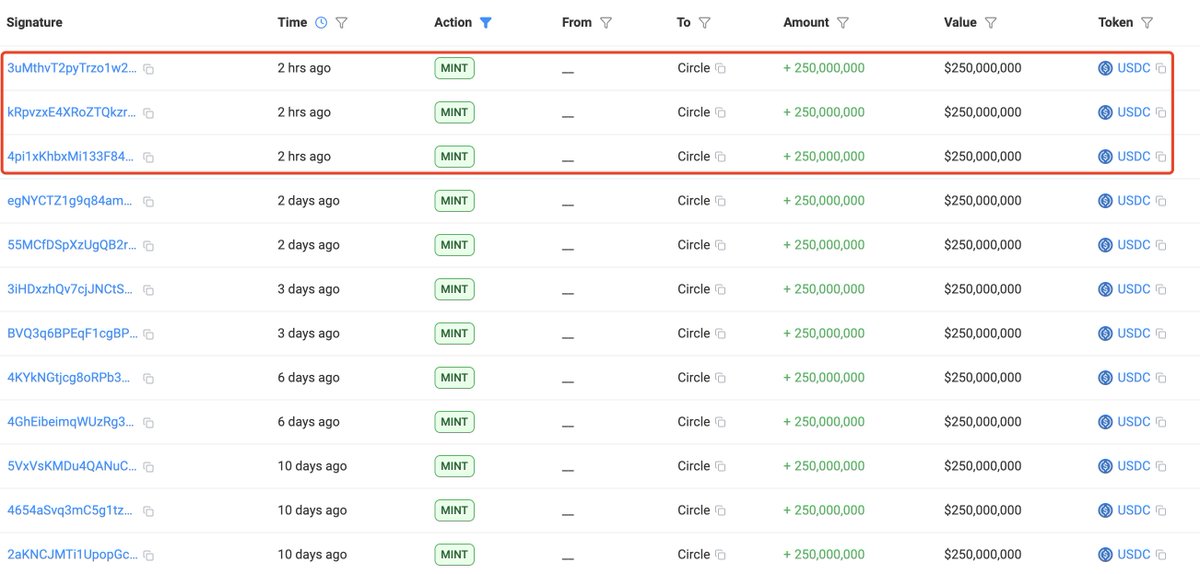

- Stablecoin issuance has surged, with Tether (USDT) and Circle's USDC minting over $14 billion since the October 10 market crash.

- This increase in stablecoin supply suggests capital is ready to be deployed once market confidence improves, historically preceding rebounds.

Circle’s USDC Minting Extends Liquidity Amid Bearish Sentiment

Circle recently minted an additional $750 million in USDC, contributing to overall liquidity inflows. This activity indicates capital is parked on the sidelines, awaiting improved market conditions.

- Despite increased liquidity, market sentiment remains fearful due to persistent selling pressure and Bitcoin's fall below $100,000.

- The contrast between liquidity inflows and market performance suggests a complex environment where capital accumulation isn't yet translating into buying momentum.

USDC Dominance Climbs as Investors Seek Stability

USDC dominance has risen to 2.33%, its highest in nearly a year, reflecting a shift toward stability amid market volatility. Investors are moving holdings into stablecoins like USDC to preserve capital as Bitcoin and altcoins face downturns.

- USDC dominance has surpassed its 50-day and 100-day moving averages, suggesting a focus on capital preservation during market corrections.

- The recent USDC minting and rising stablecoin balances highlight investor caution, with many waiting for clear signals before reentering risk assets.

- If USDC dominance continues to climb, it may indicate further downside pressure, but a plateau or decline could signal a market rotation back into Bitcoin and altcoins.