11 2

Bitwise Predicts Bitcoin, Ethereum, and Solana to Hit Record Highs by 2026

Bitwise, an asset manager and ETF issuer, forecasts significant growth in the crypto market by 2026, predicting new all-time highs for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Key Points

- Bitcoin is expected to break away from its four-year price cycle due to less impactful traditional factors such as halvings and interest rate changes.

- Large institutions entering the crypto space are anticipated to increase institutional allocations toward spot ETFs and enhance on-chain developments by 2026.

- Bitcoin's volatility is projected to decrease, with it showing lower volatility than Nvidia in 2025.

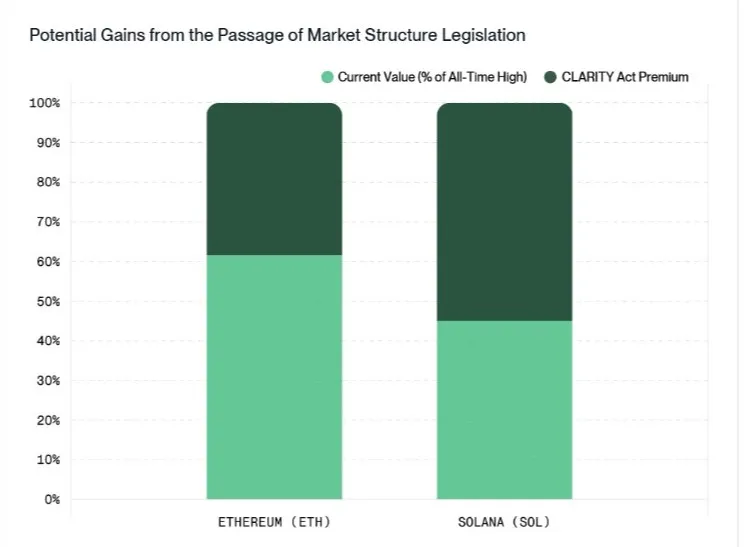

- Ethereum and Solana are expected to benefit significantly from stablecoin growth and tokenization, especially if the CLARITY Act passes.

ETF Market Dynamics

- Institutional demand for ETFs is predicted to grow, acquiring more than 100% of the new supply of Bitcoin, Ethereum, and Solana.

- Estimated new market supply by 2026 includes 166,000 BTC ($15.3 billion), 960,000 ETH ($3.0 billion), and 23 million SOL ($3.2 billion).

- Crypto equities have outperformed traditional tech stocks, with the Bitwise Crypto Innovators 30 Index increasing by 585% over three years.

Stablecoin Concerns

- The stablecoin market, valued at nearly $300 billion, is expected to reach $500 billion by 2026.

- Stablecoins might be blamed by some countries for destabilizing their currencies, despite being a refuge from unstable local currencies.

Future Outlook

- Over 100 crypto-linked ETFs are expected to launch in the U.S., following new SEC listing standards.

- Half of Ivy League endowments may invest in cryptocurrencies, and on-chain vault assets under management are likely to double.

Currently, Bitcoin trades at $86,165, with losses of 2% in the last 24 hours and nearly 7% over the past week, standing 31.8% below its all-time high of $126,000.