17 1

Bitcoin Price Falls 2% Amid Large Exchange Deposits by OGs

Bitcoin's price began the week with a decline, falling to $107,000 and reflecting a 2% drop in market cap. This decrease follows significant BTC deposits by early holders into major exchanges, indicating potential sell-offs.

- An early Bitcoin investor deposited about 13,000 BTC ($1.48 billion) since Oct. 1 to multiple exchanges including Kraken and Binance.

- Owen Gunden moved 3,265 BTC ($364.5 million) to Kraken since Oct. 21.

Market analysts have mixed views on these whale movements. Some fear they signal a "crypto winter," while others see it as typical behavior before a market rally.

- Crypto influencer Joe suggests large transfers might indicate rotation or hedging, rather than selling.

- Increasing BTC reserves on Binance could indicate downward pressure, as buy volume remains weak during dips.

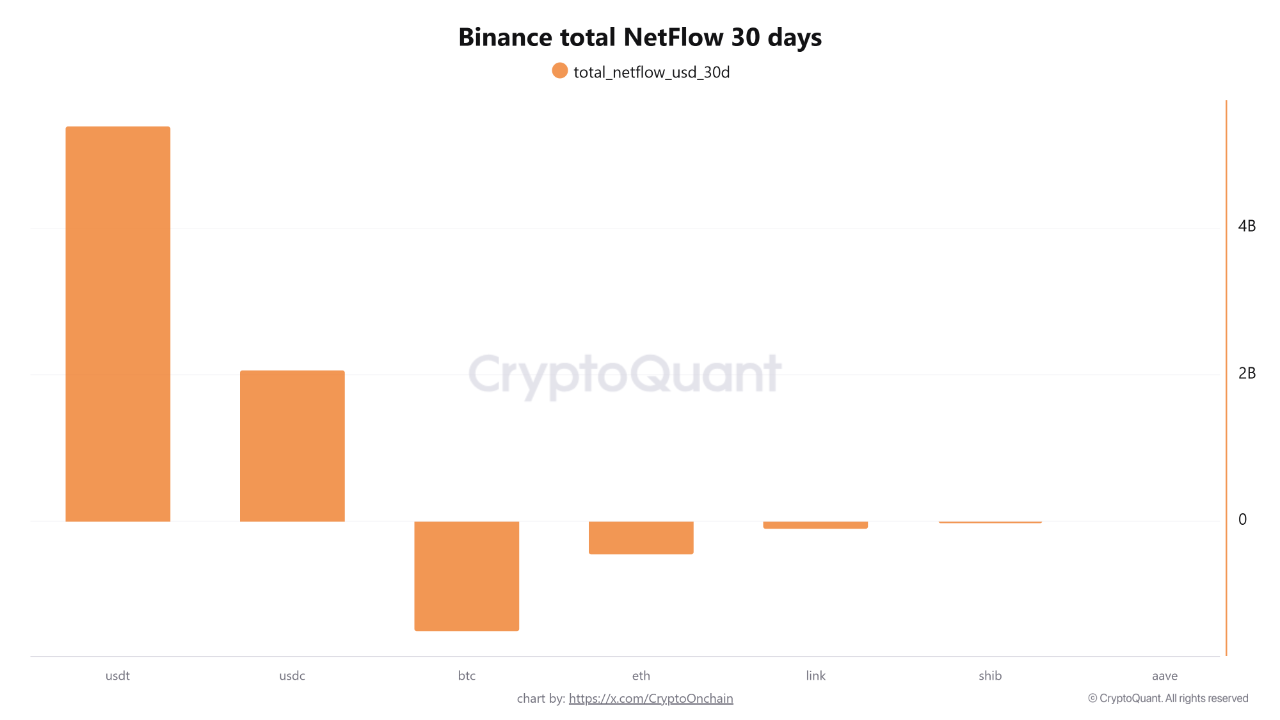

October saw Binance's record-breaking net inflow of $7 billion, driven mainly by stablecoins like USDT and USDC, totaling $5 billion and $2 billion respectively.

- Bitcoin and Ethereum experienced outflows in October, suggesting long-term holding behavior.

- Analyst Ali Martinez noted a potential "broadening top" for Bitcoin, predicting a surge followed by a reversal by year-end.