Crypto-Industrial Complex Valued at $450 Billion Ahead of Bitcoin’s Surge

Long ago, skeptics claimed bitcoin lacked intrinsic value. Critics argued that Bitcoin (BTC) was not backed by any revenue or cash flow, suggesting its worth could be zero. However, the reality is that Bitcoin supports itself; early coins were sold for the energy costs incurred in mining.

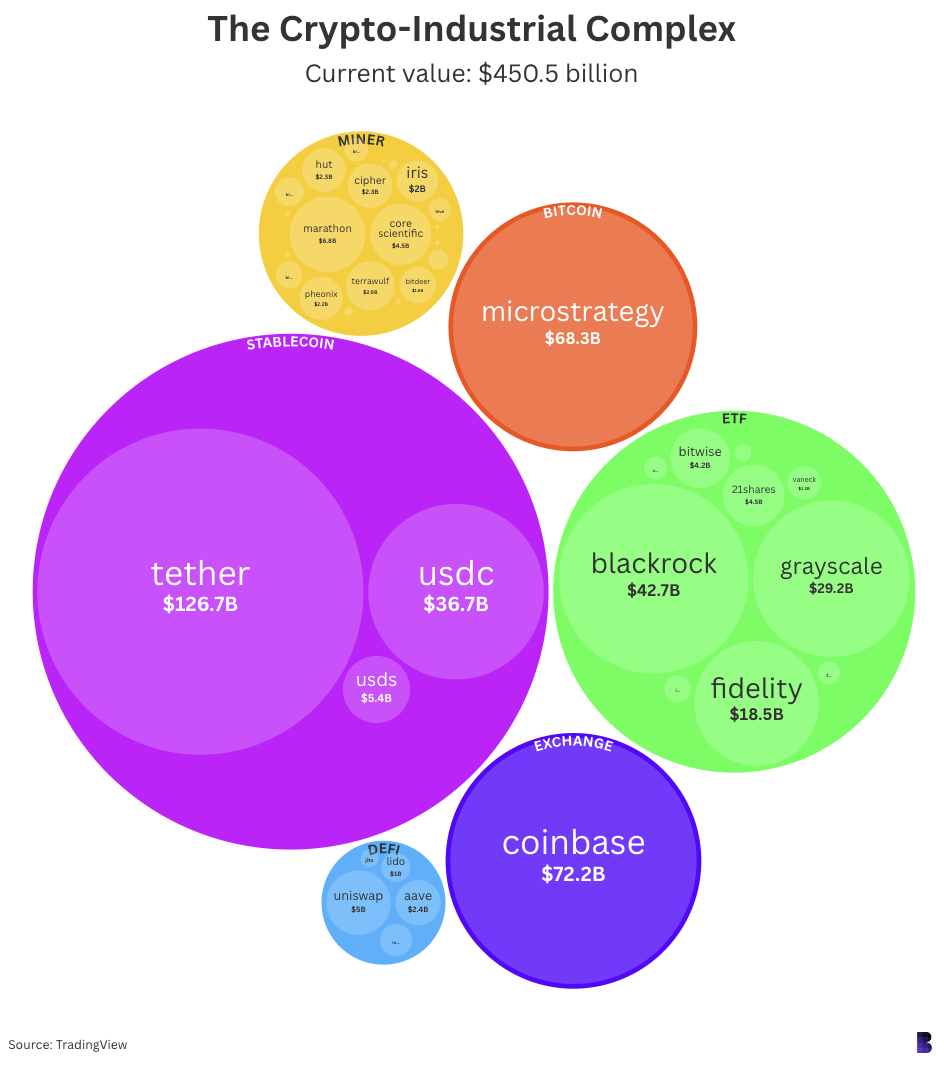

Today, Bitcoin's value is bolstered by a broader Crypto-Industrial Complex valued at nearly half a trillion dollars. This complex includes:

- Publicly-traded stocks: MicroStrategy, Coinbase, bitcoin miners, and ETFs.

- Stablecoins: USDT, USDC, and USDS (formerly DAI).

- DeFi governance: Uniswap, Raydium (DEXs), Aave (lending), and restaking apps like Lido and Jito.

The overall cryptocurrency market exceeds $3 trillion in capitalization, but the Crypto-Industrial Complex comprises key influential entities within the sector. Notable players include Ethereum giant Consensys, valued at $7 billion as of March 2022, and Solana Labs. Other significant funds holding billions in crypto assets, such as Bitwise’s index fund BITW and Grayscale trusts, also contribute to this landscape.

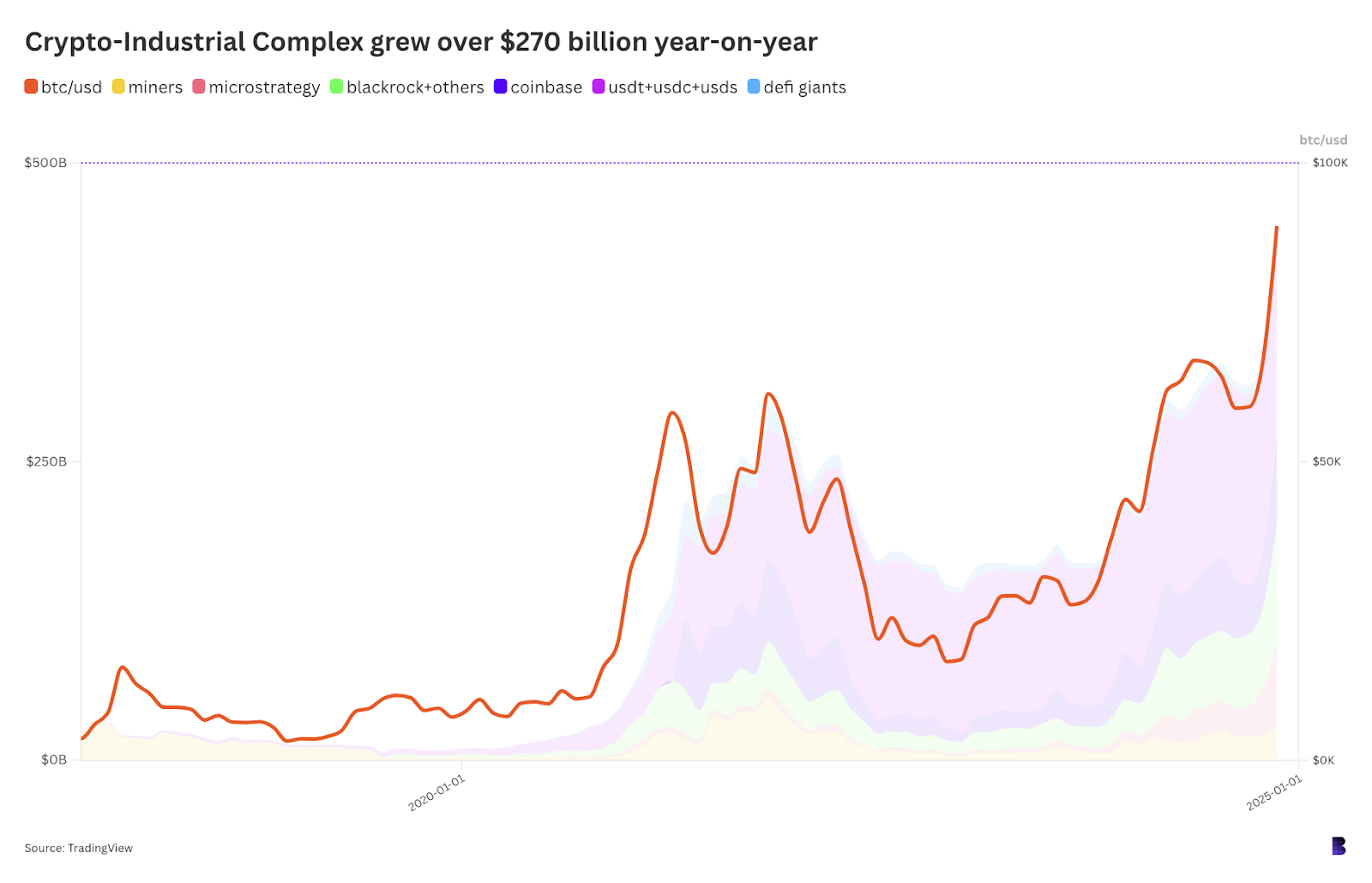

The Crypto-Industrial Complex serves as an entry point into cryptocurrency for many investors, with valuations increasing by 140% year-on-year and surpassing previous peaks from 2021. Key contributors include:

- Michael Saylor, a prominent advocate for Bitcoin.

- Tether, a stablecoin demonstrating the depth of the ecosystem.

- Uniswap, Lido, and Aave, foundational elements of DeFi.

- Public miners that support Bitcoin's network operations.

This complex continually acquires coins at a rate exceeding mining outputs. Currently, Bitcoin approaches a potential rally towards $100,000, reflecting the expanded involvement and scale of the Crypto-Industrial Complex compared to earlier iterations.