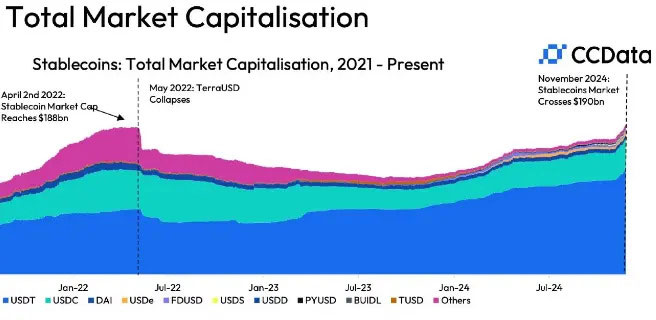

Stablecoin Market Reaches New High of $190 Billion

Stablecoins are significantly transforming the cryptocurrency ecosystem. Recent data from CCData indicates that the stablecoin market has reached $190 billion, surpassing its previous peak.

Photo: CCData

This growth occurs alongside significant political and economic changes, with Bitcoin and Solana reaching record highs. Stablecoins, which maintain stable values typically pegged to traditional currencies like the US dollar, have become essential for cryptocurrency trading and investment strategies.

Tether's USDT leads the market with a 69.9% share and a valuation of $132 billion. Circle's USDC follows, growing to nearly $39 billion, representing 20.5% of the market.

Ethena’s Synthetic Dollar Soars 42%

The stablecoin ecosystem is evolving with innovative products. Platforms like BlackRock's BUIDL and Ethena's USDe offer new approaches to digital asset stability. Ethena's synthetic dollar increased by 42%, reaching $3.8 billion in November, with an annualized yield of 25% through advanced trading strategies.

Photo: CCData

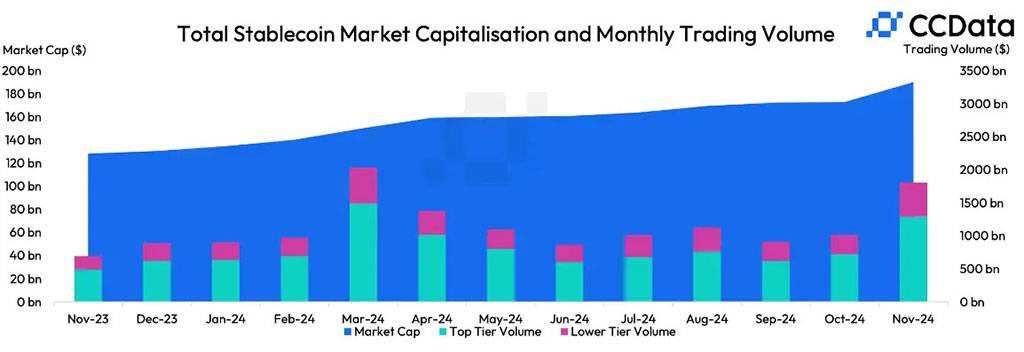

The market expansion reflects a sophisticated evolution in cryptocurrency infrastructure, with stablecoins acting as crucial liquidity mechanisms. Their ability to maintain value while providing flexibility positions them as essential tools in modern finance.

Trading volumes have surged, with stablecoin pairs on centralized exchanges increasing by 77% month-over-month to $1.8 trillion. Tether accounts for about 83% of these volumes, followed by First Digital's FDUSD and USDC.

Stablecoin’s Testament to Resilience

The current market capitalization of $190 billion is notable given past challenges, such as the Terra-Luna collapse that initiated a "crypto winter" two years ago. The stablecoin market has not only recovered but thrived, demonstrating resilience and adaptability.

Diversity within stablecoin offerings has contributed to this growth. The market now includes tokens pegged to various currencies and complex instruments like perpetual futures and crypto carry trades. Investors benefit from a wide range of options that provide stability, yield, and strategic flexibility.

With 38 tokens tracking nearly 200 digital assets reaching all-time high supplies recently, the stablecoin sector displays unprecedented dynamism. This evolution illustrates that digital assets have matured into a significant asset class with economic importance.