31 0

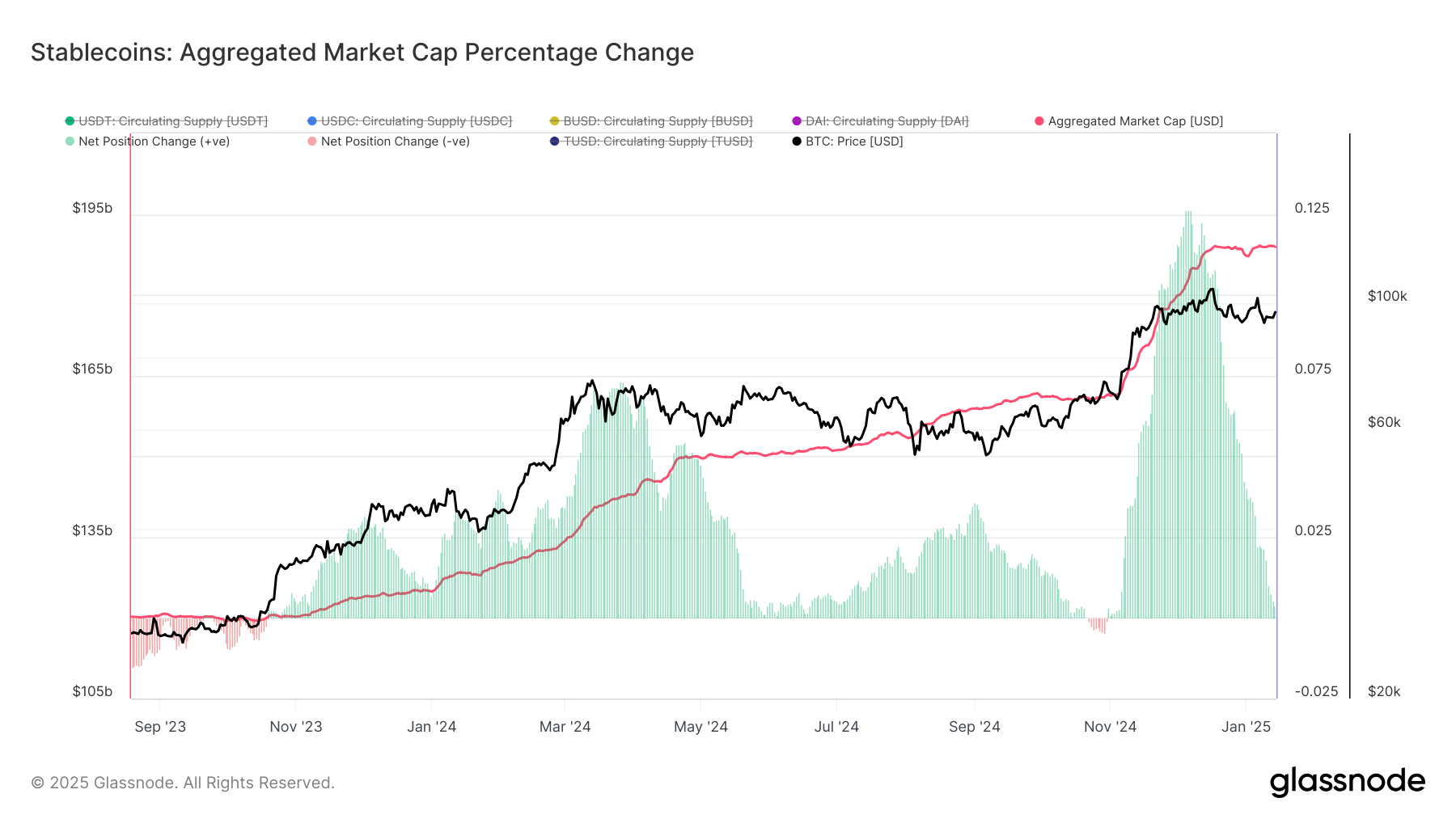

Stalled Stablecoin Supply Raises Concerns Over Bitcoin’s Recovery

Bitcoin's recovery from below $90,000 raises bullish prospects, but concerns exist regarding its sustainability. Key points include:

- Stablecoin supply stagnation indicates limited new capital inflows into the market.

- Top four stablecoins (USDT, USDC, BUSD, DAI) have stabilized around $189 billion, with a 30-day net change of 0.37%.

- The slowdown contrasts with previous liquidity expansion seen during late 2023.

- Upcoming U.S. inflation data could influence market volatility.

- Forecasts expect December's CPI to rise by 0.3% month-on-month, and 2.9% year-on-year.

- An above-forecast CPI may affect central bank interest rate decisions, impacting BTC prices.

Recent stablecoin inflows are significantly lower than those recorded in November-December ($27.3 billion), contrasting with just $14.68 billion in Q1 2024 amid a 70% price rise to over $70,000.