3 0

U.S. Investors Drive Bitcoin, Ethereum, Dogecoin Crash Amid Market Volatility

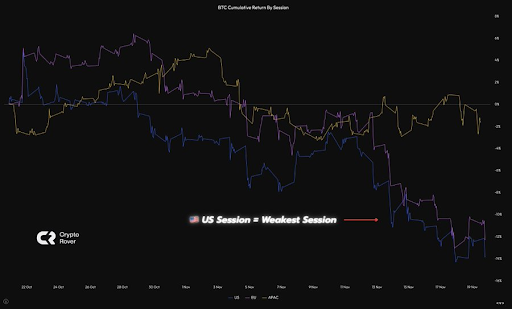

Recent analyses have identified the U.S. trading sessions as a significant source of sell pressure in the recent price decline of Bitcoin, Ethereum, and Dogecoin. The Coinbase BTC premium index is also negative, indicating weaker demand from U.S. investors.

Key Points

- The U.S. session has been the weakest, with Bitcoin losing around 12% since November began. Ethereum and Dogecoin have similarly declined.

- The EU session follows, with a similar decrease for Bitcoin, while the Asian session remains stable with minimal volatility.

- Institutional investors are likely contributing significantly to the market crash, evidenced by large outflows from Bitcoin ETFs in the past week.

- The Coinbase BTC premium index being in the red suggests lower demand on this platform compared to global averages.

- Crypto researcher Kyle Soska suggests the market could be nearing the end of its current selling phase, based on historical patterns.

- At present, Bitcoin is trading at around $85,000, reflecting a 6% drop in the past 24 hours.