ETF Outflows Reach Nearly $1 Billion Ahead of Powell’s Speech

Bitcoin (BTC) and ether (ETH) have slightly recovered from recent lows, but CoinDesk indexes indicate overall market weakness. Only OKB and LINK among the top 100 cryptocurrencies posted gains exceeding 3%.

Analysts are tracking Fed Chair Jerome Powell's upcoming speech at Jackson Hole. QCP Capital noted that short-term positioning is fragile, with potential for further market swings depending on Powell's tone regarding interest rates and upcoming labor or inflation data.

Profit-taking by short-term BTC holders has been observed, similar to a trend seen earlier this year that preceded a significant sell-off in March. Spot ETFs for BTC and ETH experienced nearly $1 billion in outflows on Tuesday.

Nicolai Sondergaard from Nansen stated that if Powell meets market expectations, crypto may experience sideways-to-slightly-bearish trends. However, markets could rally if deeper rate cuts are signaled.

Key Events

- Crypto upgrades:

- Hedera (HBAR) mainnet upgrade on Aug. 20.

- Qubic (QUBIC) halving event on Aug. 20.

- Viction (VIC) Atlas hard fork upgrade on Aug. 21.

- Macro events:

- Fed minutes release on Aug. 20.

- Powell's keynote at Jackson Hole on Aug. 22.

- Earnings reports:

- NVIDIA (NVDA) on Aug. 27.

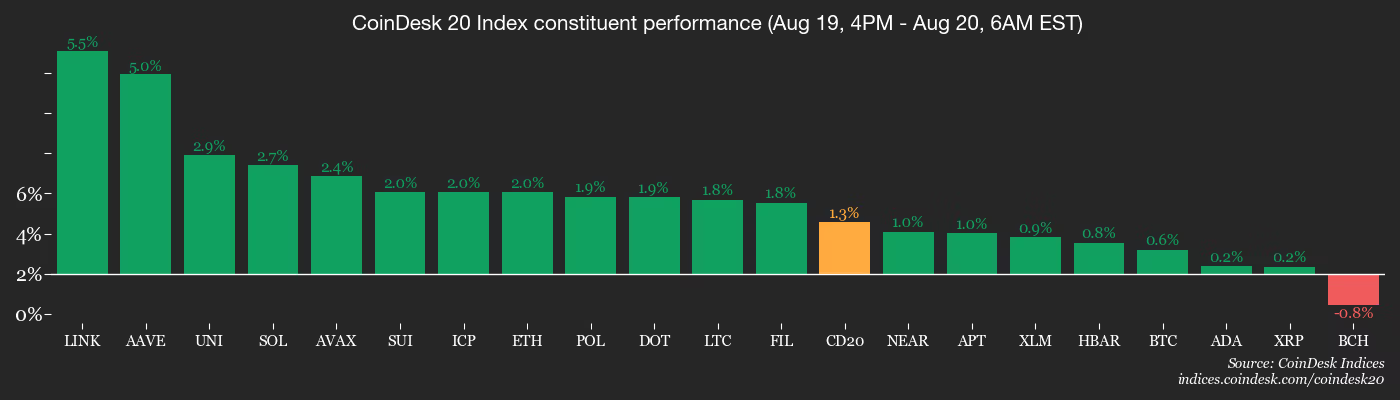

Market Movements

- BTC: $113,757.49 (-1.53%)

- ETH: $4,217.10 (-1.62%)

- CoinDesk 20 index: 3,983.85 (-2.26%)

- DXY: 98.29 (unchanged)

- Gold futures: $3,368.50 (+0.29%)

- Silver futures: $37.07 (-0.70%)

Derivatives Positioning

- $448 million in leveraged crypto futures liquidated recently, primarily long positions.

- Open interest in BTC, DOGE, and XRP has declined.

- LINK, HYPE, and SUI saw increases in open interest.

- Positive funding rates for major cryptocurrencies indicate continued bullish sentiment.

ETF Flows

- Spot BTC ETFs: -$523.3 million daily net flows.

- Spot ETH ETFs: -$422.2 million daily net flows.

Bitcoin Stats

- BTC Dominance: 59.8%

- Hashrate: 962 EH/s

- Total fees: 3.27 BTC / $374,274

Overall, the crypto market remains sensitive to macroeconomic cues, particularly from the Federal Reserve, while facing significant profit-taking and bearish sentiments across various assets.