Market Dynamics Shift as Older Coins Struggle to Keep Up

Abe Simpson’s rant about aging applies to the crypto market. Five years ago, popular assets included Litecoin, XRP, Stellar, Cardano, Zilliqa, Waltonchain, Lisk, and OmiseGO. The definition of “it” has evolved, with current trends including AI agent memecoins and various rug pulls.

2019 feels distant, predating Bored Apes, Ethereum layer-2s, and other memecoins. However, the top three coins remain consistent: BTC, ETH, and XRP, which also held podium positions in July 2016. Outside these, many projects have fallen off; NEO, IOTA, Tezos, Ontology, NEM, and Zcash were once top-25 but now only Tezos is barely in the top 100, supplanted by Solana, Toncoin, Avalanche, and Chainlink.

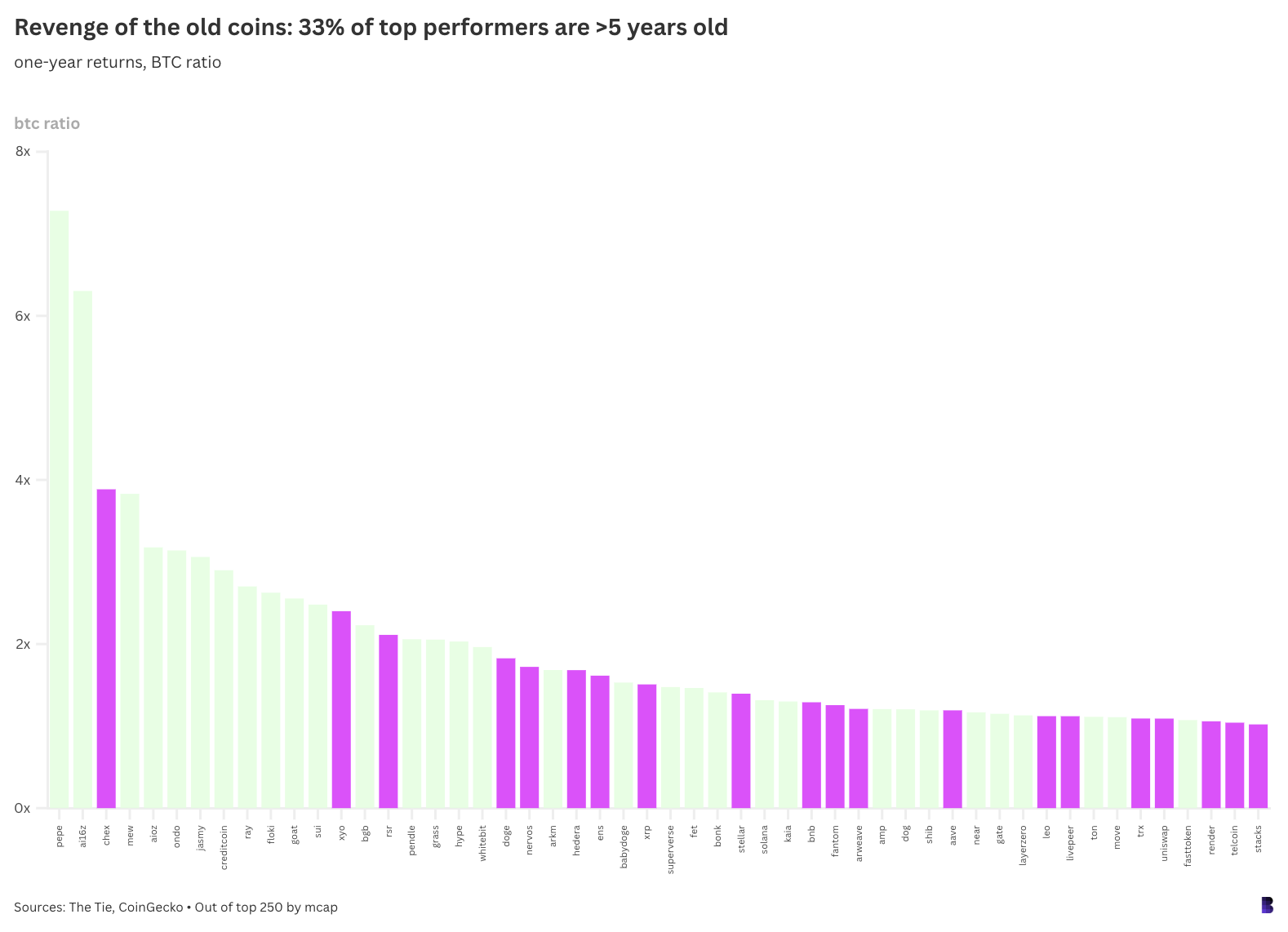

As the market anticipates an altcoin season, some older coins are maintaining relevance. An analysis of the current top 250 coins by market cap reveals that one-third of non-stablecoin projects (61 out of 188) have seen their bitcoin ratios rise over the past year, indicating they have outperformed BTC. Among these, around one-third are considered “dino coins,” tied to projects launched at least five years ago.

The best-performing dino coin in the last year is CHEX from Chintai, which has returned approximately 300% against BTC. Seven newer tokens were excluded from the analysis due to extreme percentage increases in their bitcoin ratios, including several memecoins.

Notable older coins such as DOGE, XRP, XLM, BNB, and TRX have rallied recently, alongside lesser-known tokens like Livepeer, Telcoin, Nervos, Reserve Rights, and XYO gaining traction. This altcoin season appears to cater to diverse interests beyond mainstream appeal.